Securitize Inc

Advertisement

Securitize Inc is a San Francisco-based company that aims to democratize access to private capital markets. They provide a platform that allows investors to invest in carefully vetted investment opportunities, including startup equity, funds, commodities, and real estate. With their primary market and secondary market offerings, investors can fund the next generation of world-class startups and trade private shares like stocks. Securitize Inc differentiates itself by offering unique and highly vetted investment offerings, zero commissions on primary market investments, and competitive fees for secondary market trading. They also utilize blockchain technology to register ownership rights and provide immediate settlement of trades through smart contracts.

As a member of FINRA and registered with the SEC, Securitize Inc ensures compliance with regulations and provides a secure investment environment. Their mission is to make private markets accessible to a wider audience, as private markets have been growing at a faster rate than public markets. By tokenizing traditional financial products and registering ownership rights on the blockchain, Securitize Inc enables investors to prove ownership and unlock liquidity in a more efficient manner. Through a simple 3-step process of creating a Securitize iD, funding the account, and participating in investment opportunities, investors can build their portfolios and take advantage of alternative investments.

Generated from the website

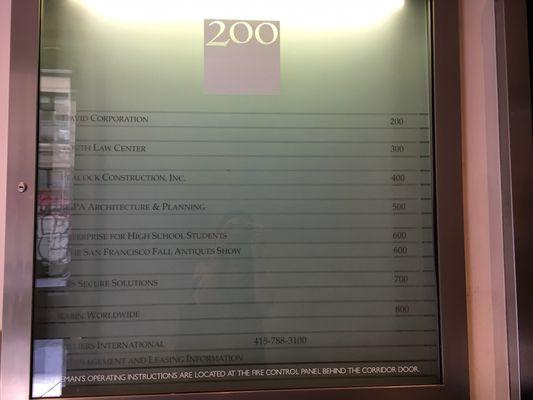

Also at this address

You might also like

Partial Data by Infogroup (c) 2024. All rights reserved.

Advertisement